What is BC IDMTC Tax Credit

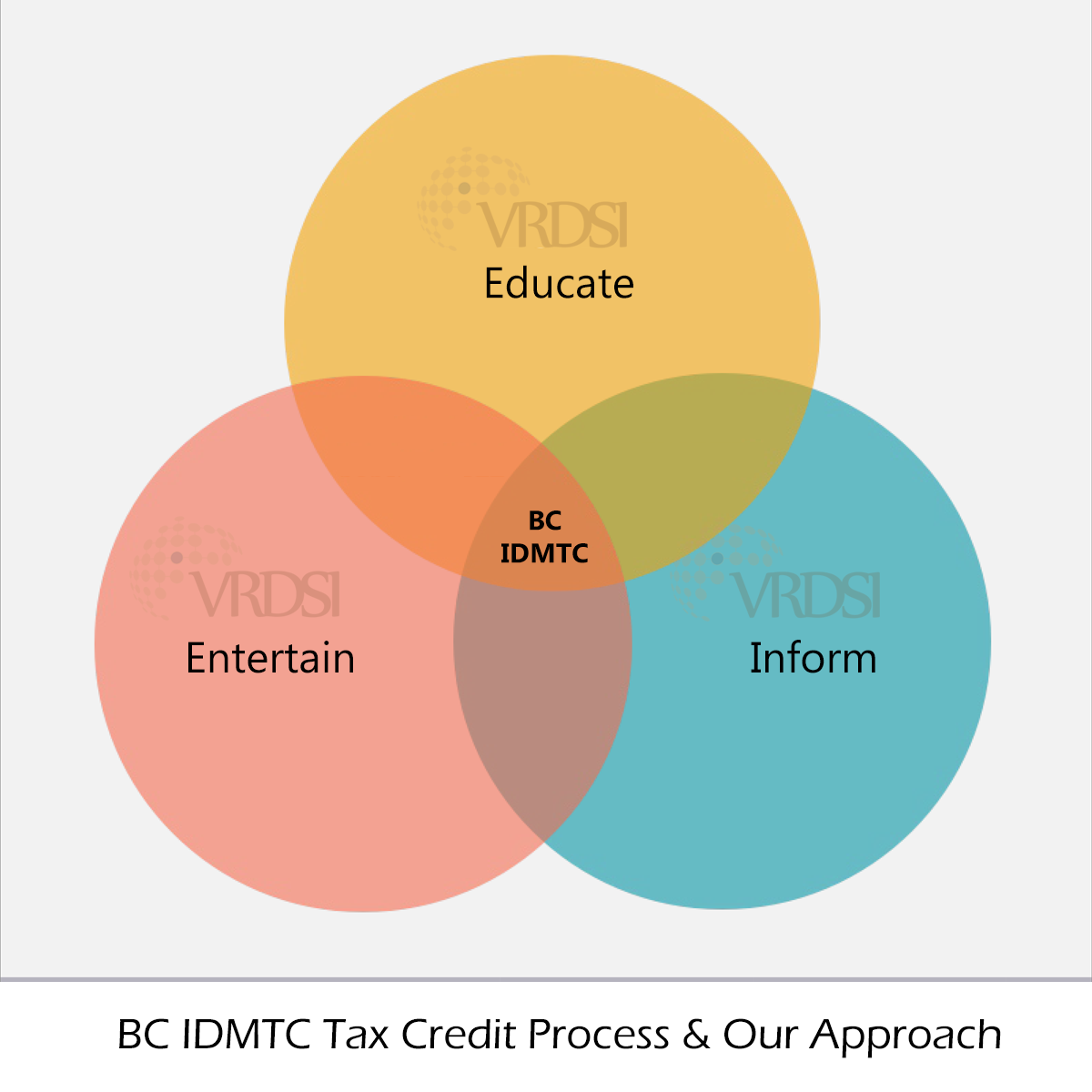

The British Columbia Interactive Digital Media Tax Credit (BC IDMTC) is a refundable tax credit available to corporations operating in British Columbia. To qualify for the BC IDMTC, a corporation must produce interactive digital media products that educate, inform or entertain.

Qualifying companies are eligible to receive a refundable tax credit of 17.5% on eligible salaries and wages incurred in the development of an interactive digital media product. The credit is claimed on an annual basis and covers many costs not eligible under SR&ED. The BC IDMTC is available to qualifying companies developing eligible product from August 31, 2010 to August 31, 2018.

*Eligibility criteria to qualify for BC IDMTC Tax Credit

BC corporation can qualify for the IDMTC if it meets all of the requirements below:

- has a permanent establishment in British Columbia.

- is a taxable Canadian entity for the duration of the same fiscal year.

- has more than $100,000 of eligible salaries and wages.

AND either - its main business is developing interactive digital media solutions.

OR - all or substantially all of its business activities consists of:

(i) developing interactive digital media solutions; and/or

(ii) consulting eligible activities to companies that have a permanent establishment in BC and whose main business is developing interactive digital media products.

*Provincial SR&ED cannot be claimed if you are claiming IDMTC (it must be one or the other)

IDMTC is undergoing ‘proposed’ changes that may allow (under very strict guidelines) for tax years after Feb. 22, 2017: Virtual Reality Products; Augmented Reality Products; and may allow applications from corporation with more than $2M of BC labour expense (even if their primary business is not the development of interactive digital media products).

VRDSI Professional BC IDMTC Tax Credit Claim Consultants

Get in touch for an assessment to find out how we can help you.

Vancouver R&D Services Inc.

Vancouver R&D Services Inc.